Reliance Capital shares hit lowest level in over 15 years, Know the Reason...

[Edited By: Gaurav]

Friday, 14th June , 2019 06:54 pmShares of Reliance Capital lost more than 6% during intraday trades on Thursday, dropping to their lowest level in more than 15 years after the resignation of Price Waterhouse & Co.

The title suffered a shock, all companies of the group Anil Dhirubhai Ambani (ADAG) also losing ground Thursday. Reliance Capital shares reached a low of ¥ 82 on Thursday, the lowest since November 25, 2003 (£ 83.24). Incidentally, equities lost nearly 64% in the current calendar year, while the Sensex benchmark gained just over 10%.

"The group has gone through difficult times because of the high debt or debt that appears in the balance sheets of its companies," said Arun Kejriwal of Kejriwal Research and Investment Services.

"Although they have liquidated some debts, there are still concerns about the future pruning of debt on the balance sheet. It is also feared that after the settlement of this debt by the liquidation of assets, the generated income is sufficient for the companies in the group can continue to operate, "he added.

In a letter to Reliance Capital on June 11, PWC stated that "as part of the ongoing audit for 2018-2019, we noted certain observations / transactions that, in our assessment, could, if not were not satisfactorily resolved, significant, material and substantial in the financial statements. "

"We have not received substantial / satisfactory answers to our questions in the light of our observations," says the letter.

Aside from Reliance Capital, ADAG entities such as Reliance Home Finance and Reliance Communications reached their lowest level of 52 weeks on Thursday.

At the same time, the ongoing liquidity crisis has made investors bearish to major banks. Shares of Yes Bank lost close to 13%, or £ 25.49, to close at £ 117.20 after UBS reduced its target price by 47% from £ 170 to £ 90 previously. The Indusind Bank also lost nearly 5%, or £ 77.70, to close at £ 1,490.05.

Latest News

-

2-Doxy-D is a game-changer drug - discovered by sc

-

UP Covid News: Recovery rate rises 86 percent in U

-

Big B orders 50 oxygen concentrators from Poland,

-

Today is Akshay tritiya-PM Modi and Akhilesh yadav

-

Kanpur health department doing preparations to fig

-

UP Govt. must be held accountable for "failing" it

-

16 doctors in Unnao UP resign yesterday but retrac

-

Vaccine is safety cycle against corona pandemic-CM

-

Life of every person is priceless,rescue is the be

-

Kanpur Municipal Corporation will make dust free K

-

Corona vaccination: UP government withdraws the de

-

UP Government should follow the orders of Highcour

-

Uttar Pradesh-IG roaming in the city without the u

-

PM, take off those pink goggles, by which nothing

-

Rahul Gandhi's counterattack on BJP Government’s s

-

Happy international nurse day-PM Modi, Rahul Gandh

-

Online food delivery and liquor shops can open the

-

Egoistic BJP should work in public interest instea

-

High court directed UP Government to make a Covid

-

Isolation rooms to be built in industrial units, a

-

WHO has appreciated the effort of the Yogi Adityan

-

Brother is forced to carry his corona afflicted br

-

Lucknow- Free auto service for covid patients

-

Lucknow-Defense Minister and CM Yogi inaugurated

-

Wine shops opened in kanpur

-

Kanpur: oxygen demand 50 percent decrease as infec

-

Kanpur Crime Branch Police arrested 2 accused of i

-

Kanpur police's initiative to prevent corona infec

-

CM Yogi inspected the community health center in c

-

Corona's third wave: IIT professor claims not to c

World News

-

American president Appoints Two More Indian To Key

-

Arora Akanksha an Indian running for United Nation

-

Brazil thankes india with hanuman after receiving

-

Toronto protest against Indian citizenship law as

-

One-Of-A-Kind Wedding: After Groom's Father Gets A

-

Kim's Horse Ride On Sacred Mountain Hints At "Grea

-

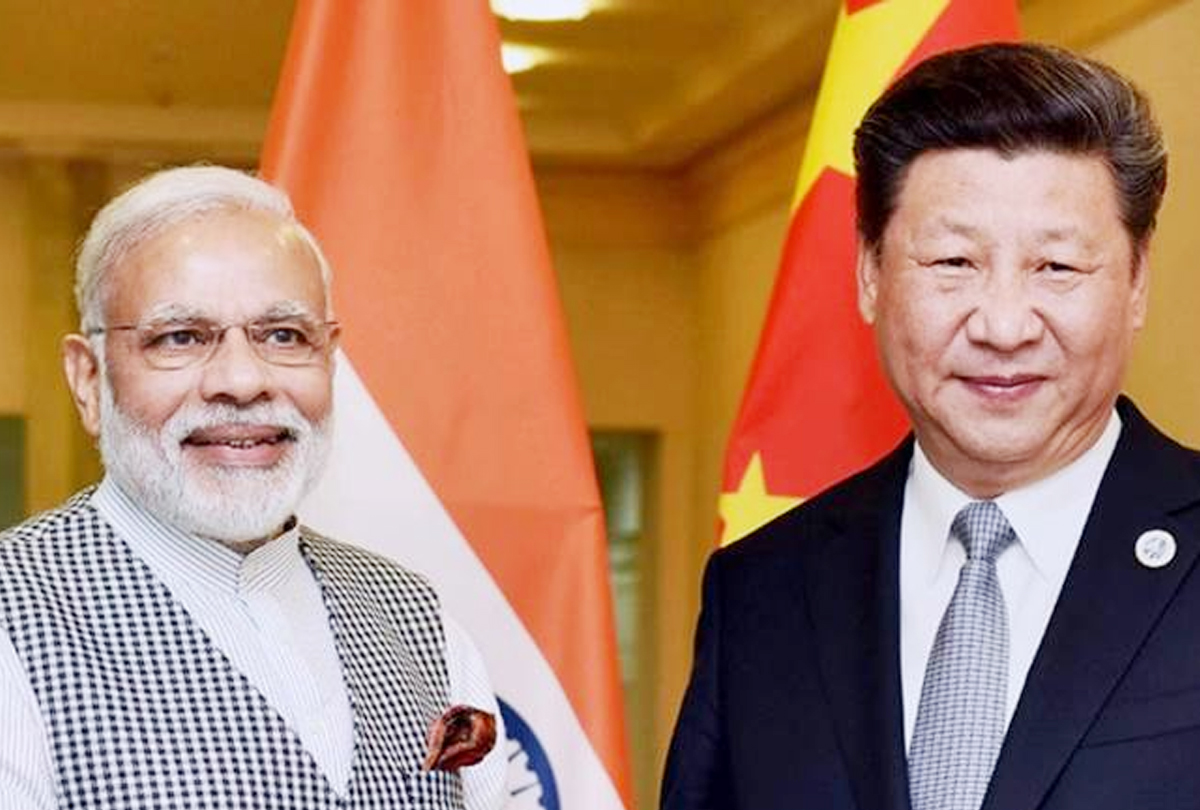

Chinese President’s India visit on track, confirms

-

'Howdy Modi' event 'win-win' situation for Modi an

-

Malala urges U.N. to help Kashmiri children go bac

-

Rocket blast at U.S. Embassy in Kabul on 9/11 anni

-

PM Modi launches $4.2 mn redevelopment project of

-

Pakistan Blacklisted by FATF's: After Failing to A

-

Amazon Rainforest burning: Brazil President tells

-

10 shoking pics of Amazon Rainforest Burning

-

200 pakistan twitter accounts suspended on kashmir

-

Trump dials Imran Khan, asks to ‘moderate rhetoric

-

No policy change on Kashmir, says U.S.

-

Hamza, the son of Osama bin Laden, is dead

-

Ethiopians planted more than 200 million trees in

-

Pakistani military aircraft crash: All 5 crew memb