Three years of demonetisation: Core problems note ban sought to address remain; pain outweighs gains

[Edited By: Gaurav]

Friday, 8th November , 2019 11:46 amThree years ago, on the evening of 8 November 2016, Prime Minister Narendra Modi appeared on national television to announce the most disruptive economic move any country has ever attempted in modern history. In one go, the prime minister invalidated 86 percent of the currency in the economy in the form of two high-value notes, Rs 500 and Rs 1,000.

To be sure, a few countries, India including, had attempted demonetisation before as well. But there was no comparison in terms of the scale of the exercise. Note ban sucked out majority cash from the system overnight while there was no immediate remonetisation plan in place. Modi's announcement instantly triggered panic even among the general public with legit cash.

Long queues were formed in front of automated teller machine (ATMs) within minutes and bank branches in the following working days. People waited to withdraw cash and deposit the stock of invalidated notes in exchange of the valid currencies. The exercise spread chaos in the cash-dominated informal economy breaking supply chains and crippling small businesses and big businesses in some or the other manner.

The Reserve Bank of India (RBI) issued over 60 circulars on the rules pertaining to cash/withdrawal and deposits in the following weeks. Confusion prevailed across different walks of life.

The RBI often acted like it was clueless about the real situation on the ground. It took five to six months for the central bank remonetise the system making cash available to the general public.

Tax cheats, as usual, found a way around to whiten their black money. Many split the amount into small chunks and deposited through different accounts, there were cases of private employers paying advance salaries for up to a year to their employees to get rid of cash. Some rushed to gold jewelers to convert their cash into physical holdings.

More than 99 percent of the cash returned to the system belying the government's initial expectations. The government initially thought that at least Rs 3 to 4 lakh crore unaccounted money would be extinguished outside the banking system and this will lead to a windfall to the government. That, clearly, didn't happen. What has demonetisation achieved in the three years since it was launched? There were three main targets initially announced by the prime minister in his televised speech. 1) Curbing black money in the economy in the form of cash 2) terminating cash-based corruption and 3) killing fake currency.

There were also goals added later such as curbing terrorist activities where cash exchange is dominant, pushing digital transactions, widening the tax base and so on. Are these targets achieved in the three years? If one conducts a reality check analysing various ground reports and studies, the core issues that the note ban sought to terminate still remain on the ground.

Note ban did not kill unaccounted cash

According to experts' estimates, black money in the form of cash was only about 5 percent of the total stock, while the remaining was either in the form of real estate investments, gold or other assets. Hence, the idea that the note ban would kill unaccounted cash was a dud from Day One. Even the RBI directors hadn't agreed with the government argument that the note ban will help curb black money in a significant manner.

"While any incidence of counterfeiting is a concern, Rs 400 crore as a percentage of the total quantum of currency in circulation is not very significant," they said.

In short, there is no material evidence to prove that the demonetisation has significantly reduced black money in the system.

New Rs 2,000 note finds itself in black money seizures

What about counterfeit notes? Fake currency notes worth Rs 28.1 crore were seized in 2017, which rose 76 percent from the previous year's mark of Rs 15.9 crore, according to the Crime in India-2017 report put together by the National Crime Records Bureau (NCRB), News18 reported.

Latest News

-

2-Doxy-D is a game-changer drug - discovered by sc

-

UP Covid News: Recovery rate rises 86 percent in U

-

Big B orders 50 oxygen concentrators from Poland,

-

Today is Akshay tritiya-PM Modi and Akhilesh yadav

-

Kanpur health department doing preparations to fig

-

UP Govt. must be held accountable for "failing" it

-

16 doctors in Unnao UP resign yesterday but retrac

-

Vaccine is safety cycle against corona pandemic-CM

-

Life of every person is priceless,rescue is the be

-

Kanpur Municipal Corporation will make dust free K

-

Corona vaccination: UP government withdraws the de

-

UP Government should follow the orders of Highcour

-

Uttar Pradesh-IG roaming in the city without the u

-

PM, take off those pink goggles, by which nothing

-

Rahul Gandhi's counterattack on BJP Government’s s

-

Happy international nurse day-PM Modi, Rahul Gandh

-

Online food delivery and liquor shops can open the

-

Egoistic BJP should work in public interest instea

-

High court directed UP Government to make a Covid

-

Isolation rooms to be built in industrial units, a

-

WHO has appreciated the effort of the Yogi Adityan

-

Brother is forced to carry his corona afflicted br

-

Lucknow- Free auto service for covid patients

-

Lucknow-Defense Minister and CM Yogi inaugurated

-

Wine shops opened in kanpur

-

Kanpur: oxygen demand 50 percent decrease as infec

-

Kanpur Crime Branch Police arrested 2 accused of i

-

Kanpur police's initiative to prevent corona infec

-

CM Yogi inspected the community health center in c

-

Corona's third wave: IIT professor claims not to c

World News

-

American president Appoints Two More Indian To Key

-

Arora Akanksha an Indian running for United Nation

-

Brazil thankes india with hanuman after receiving

-

Toronto protest against Indian citizenship law as

-

One-Of-A-Kind Wedding: After Groom's Father Gets A

-

Kim's Horse Ride On Sacred Mountain Hints At "Grea

-

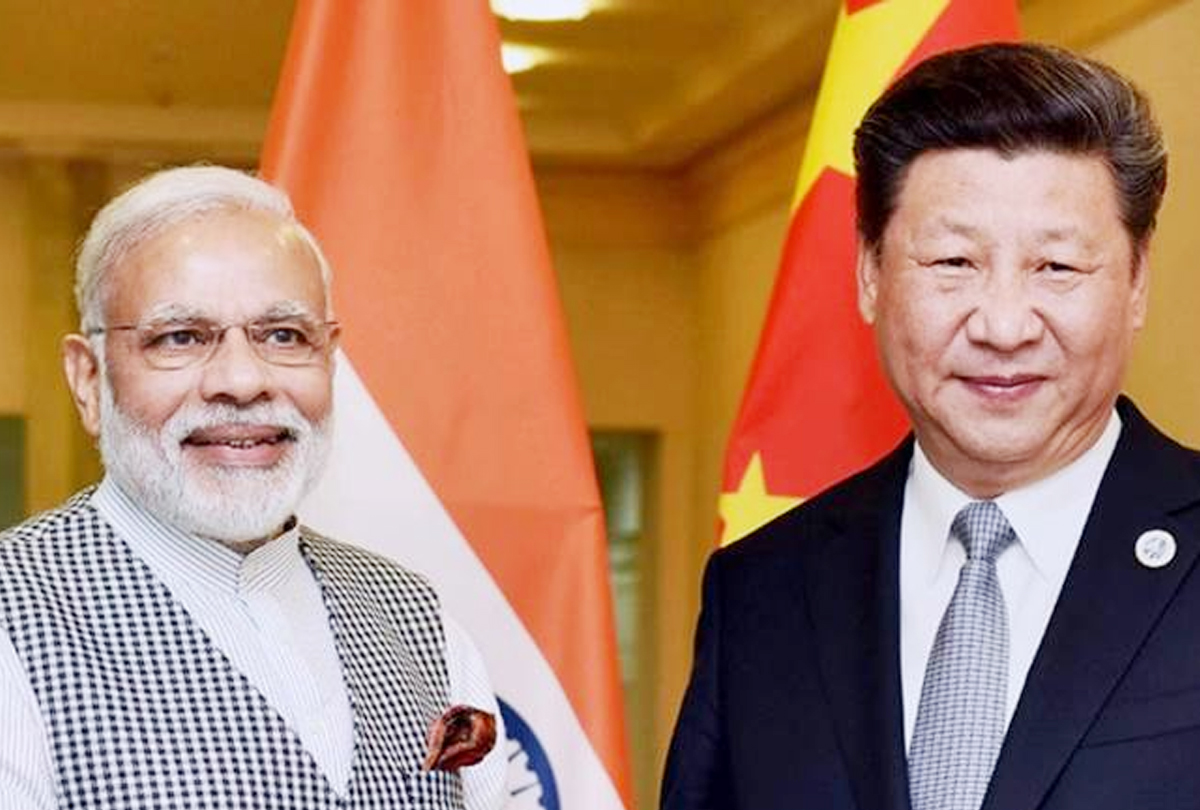

Chinese President’s India visit on track, confirms

-

'Howdy Modi' event 'win-win' situation for Modi an

-

Malala urges U.N. to help Kashmiri children go bac

-

Rocket blast at U.S. Embassy in Kabul on 9/11 anni

-

PM Modi launches $4.2 mn redevelopment project of

-

Pakistan Blacklisted by FATF's: After Failing to A

-

Amazon Rainforest burning: Brazil President tells

-

10 shoking pics of Amazon Rainforest Burning

-

200 pakistan twitter accounts suspended on kashmir

-

Trump dials Imran Khan, asks to ‘moderate rhetoric

-

No policy change on Kashmir, says U.S.

-

Hamza, the son of Osama bin Laden, is dead

-

Ethiopians planted more than 200 million trees in

-

Pakistani military aircraft crash: All 5 crew memb