Modi government plans to directly tax Google, Facebook and Twitter

[Edited By: Gaurav]

Wednesday, 31st July , 2019 02:47 pmThe Indian government plans to directly tax big tech companies on the profits they make locally. The center is currently considering an income threshold of 20 billion rupees and a user base of at least 500,000 users above which non-resident technology companies such as Facebook, Facebook and Twitter should pay direct taxes to government on the profits made locally.

the proposed taxes are part of the Significant Economic Presence (PES) which was introduced for the first time after the budget was tabled last year. The Central Council for Direct Taxes (CBDT) closely followed the introduction of the concept of PES, calling for suggestions, which set the rules of the taxation system last July.

The Indian government, in addition to levying taxes on large technology companies under the SEP, is also considering introducing the taxation regime in the Direct Tax Code, which aims to simplify the country's tax laws. direct.

The SEP will levy a tax of about 35% on large technology companies, which is similar to the tax paid by local businesses, the report noted.

The Indian government, Nirmala Sitharaman, urges the G20 countries to adopt the SEP as a concept to tax big technology companies and to cooperate closely with member countries. "Fugitive economic offenders".

This decision comes at a time when the European Union is considering levying a 3% tax on foreign technology companies for the profits they make locally.

Latest News

-

2-Doxy-D is a game-changer drug - discovered by sc

-

UP Covid News: Recovery rate rises 86 percent in U

-

Big B orders 50 oxygen concentrators from Poland,

-

Today is Akshay tritiya-PM Modi and Akhilesh yadav

-

Kanpur health department doing preparations to fig

-

UP Govt. must be held accountable for "failing" it

-

16 doctors in Unnao UP resign yesterday but retrac

-

Vaccine is safety cycle against corona pandemic-CM

-

Life of every person is priceless,rescue is the be

-

Kanpur Municipal Corporation will make dust free K

-

Corona vaccination: UP government withdraws the de

-

UP Government should follow the orders of Highcour

-

Uttar Pradesh-IG roaming in the city without the u

-

PM, take off those pink goggles, by which nothing

-

Rahul Gandhi's counterattack on BJP Government’s s

-

Happy international nurse day-PM Modi, Rahul Gandh

-

Online food delivery and liquor shops can open the

-

Egoistic BJP should work in public interest instea

-

High court directed UP Government to make a Covid

-

Isolation rooms to be built in industrial units, a

-

WHO has appreciated the effort of the Yogi Adityan

-

Brother is forced to carry his corona afflicted br

-

Lucknow- Free auto service for covid patients

-

Lucknow-Defense Minister and CM Yogi inaugurated

-

Wine shops opened in kanpur

-

Kanpur: oxygen demand 50 percent decrease as infec

-

Kanpur Crime Branch Police arrested 2 accused of i

-

Kanpur police's initiative to prevent corona infec

-

CM Yogi inspected the community health center in c

-

Corona's third wave: IIT professor claims not to c

World News

-

American president Appoints Two More Indian To Key

-

Arora Akanksha an Indian running for United Nation

-

Brazil thankes india with hanuman after receiving

-

Toronto protest against Indian citizenship law as

-

One-Of-A-Kind Wedding: After Groom's Father Gets A

-

Kim's Horse Ride On Sacred Mountain Hints At "Grea

-

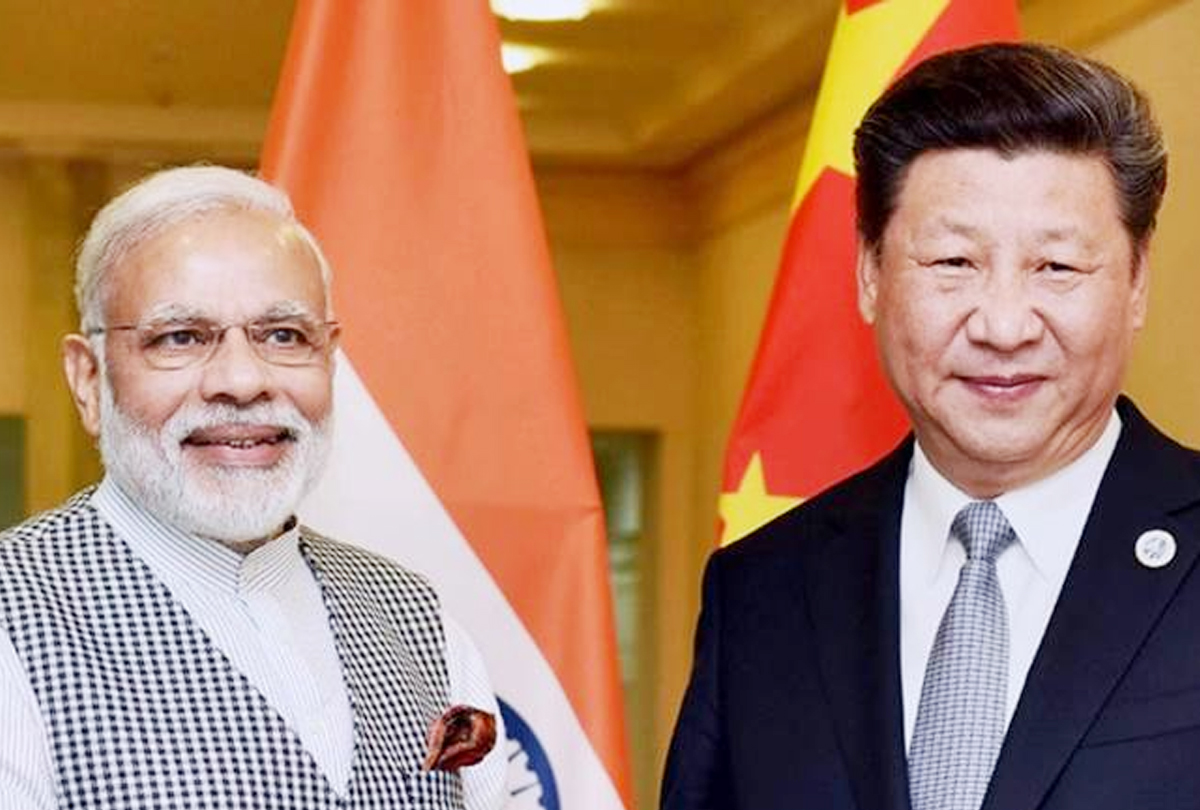

Chinese President’s India visit on track, confirms

-

'Howdy Modi' event 'win-win' situation for Modi an

-

Malala urges U.N. to help Kashmiri children go bac

-

Rocket blast at U.S. Embassy in Kabul on 9/11 anni

-

PM Modi launches $4.2 mn redevelopment project of

-

Pakistan Blacklisted by FATF's: After Failing to A

-

Amazon Rainforest burning: Brazil President tells

-

10 shoking pics of Amazon Rainforest Burning

-

200 pakistan twitter accounts suspended on kashmir

-

Trump dials Imran Khan, asks to ‘moderate rhetoric

-

No policy change on Kashmir, says U.S.

-

Hamza, the son of Osama bin Laden, is dead

-

Ethiopians planted more than 200 million trees in

-

Pakistani military aircraft crash: All 5 crew memb