Five reasons for the slow death of DHFL by default

[Edited By: Gaurav]

Monday, 15th July , 2019 01:34 pmThere is a high risk market in India and it is not a retailer. It consists of risky real estate agents with doubtful credit who obtained loans from lenders greedy enough to take risks they were not meant to take on.

The first possible low is Dewan Housing Finance Ltd (DHFL), a large mortgage lender that proved to be unwise for developers.

DHFL now feels that it may not be able to survive because nobody wants to give it funds. "These developments can raise a significant doubt about the Company's ability to continue as a going concern," the company said, citing financial stress, rebates as well as lack of financing as factors behind its fear. Shares of DHFL traded 31% down to 11: 20 am at ? 47.4 per piece. The reason why the funds for the housing finance company have been exhausted is that investors are no longer sure of their risk management and their credit practices.

There are valuable lessons to learn from this debacle:

1- The risk can not be replaced by anything. Loans that are risky are, in any other way, still risky. The DHFL book was largely developer loans and the prolonged slowdown in real estate should have made the lender more cautious. But DHFL does not seem to have adequately assessed this increased risk. Therefore, their gross uncollectible loans increased to 2.74%, although ideally stressed assets would be as high as 21%.

2- Investors are now realizing that the combined loans that DHFL has sold to raise money from banks may not be kosher. DHFL in its results said there is no documentation in the case of loans worth 20,750 million euros. It is not clear if part of these loans were sold or are still in the books of the lender. Brickwork Ratings downgraded a loan transaction from DHFL to C from BBB last month.

3- The loss of the March quarter of the DHFL is 223 million rupees, higher than its market capitalization which stood at 2149.53 million euros on Friday. That is now lower as the stock fell 10% today. There is concern that the company has not expressed the full degree of stress in their books. Then there is the case of the missing documentation in their loans. All in all, capital investors are perhaps the most affected.

4- Non-bank lenders, especially those like DHFL, believed that they could reinvest in their short-term loans incessantly. This encouraged them to enter into a mismatch of risky asset liability. Now they know better that this condition depends on a confidence that is fragile in a slowing economy.

5- There is still a possibility that DHFL will survive. The most important lesson for lenders who now seek to keep DHFL alive through a resolution plan is that they need to move quickly. This is difficult given that the company's lenders are part of thousands of bondholders, in addition to banks and mutual fund houses. Getting consensus around a resolution plan is a difficult task, but the survival of DHFL may depend on it.

Finally, the regulator needs to put on socks and begin to examine more closely the non-bank lenders. The National Housing Bank (NHB) noted that DHFL's capital adequacy ratio was below the regulatory minimum in FY18. Why the regulator did not take any action is strange.

Latest News

-

2-Doxy-D is a game-changer drug - discovered by sc

-

UP Covid News: Recovery rate rises 86 percent in U

-

Big B orders 50 oxygen concentrators from Poland,

-

Today is Akshay tritiya-PM Modi and Akhilesh yadav

-

Kanpur health department doing preparations to fig

-

UP Govt. must be held accountable for "failing" it

-

16 doctors in Unnao UP resign yesterday but retrac

-

Vaccine is safety cycle against corona pandemic-CM

-

Life of every person is priceless,rescue is the be

-

Kanpur Municipal Corporation will make dust free K

-

Corona vaccination: UP government withdraws the de

-

UP Government should follow the orders of Highcour

-

Uttar Pradesh-IG roaming in the city without the u

-

PM, take off those pink goggles, by which nothing

-

Rahul Gandhi's counterattack on BJP Government’s s

-

Happy international nurse day-PM Modi, Rahul Gandh

-

Online food delivery and liquor shops can open the

-

Egoistic BJP should work in public interest instea

-

High court directed UP Government to make a Covid

-

Isolation rooms to be built in industrial units, a

-

WHO has appreciated the effort of the Yogi Adityan

-

Brother is forced to carry his corona afflicted br

-

Lucknow- Free auto service for covid patients

-

Lucknow-Defense Minister and CM Yogi inaugurated

-

Wine shops opened in kanpur

-

Kanpur: oxygen demand 50 percent decrease as infec

-

Kanpur Crime Branch Police arrested 2 accused of i

-

Kanpur police's initiative to prevent corona infec

-

CM Yogi inspected the community health center in c

-

Corona's third wave: IIT professor claims not to c

World News

-

American president Appoints Two More Indian To Key

-

Arora Akanksha an Indian running for United Nation

-

Brazil thankes india with hanuman after receiving

-

Toronto protest against Indian citizenship law as

-

One-Of-A-Kind Wedding: After Groom's Father Gets A

-

Kim's Horse Ride On Sacred Mountain Hints At "Grea

-

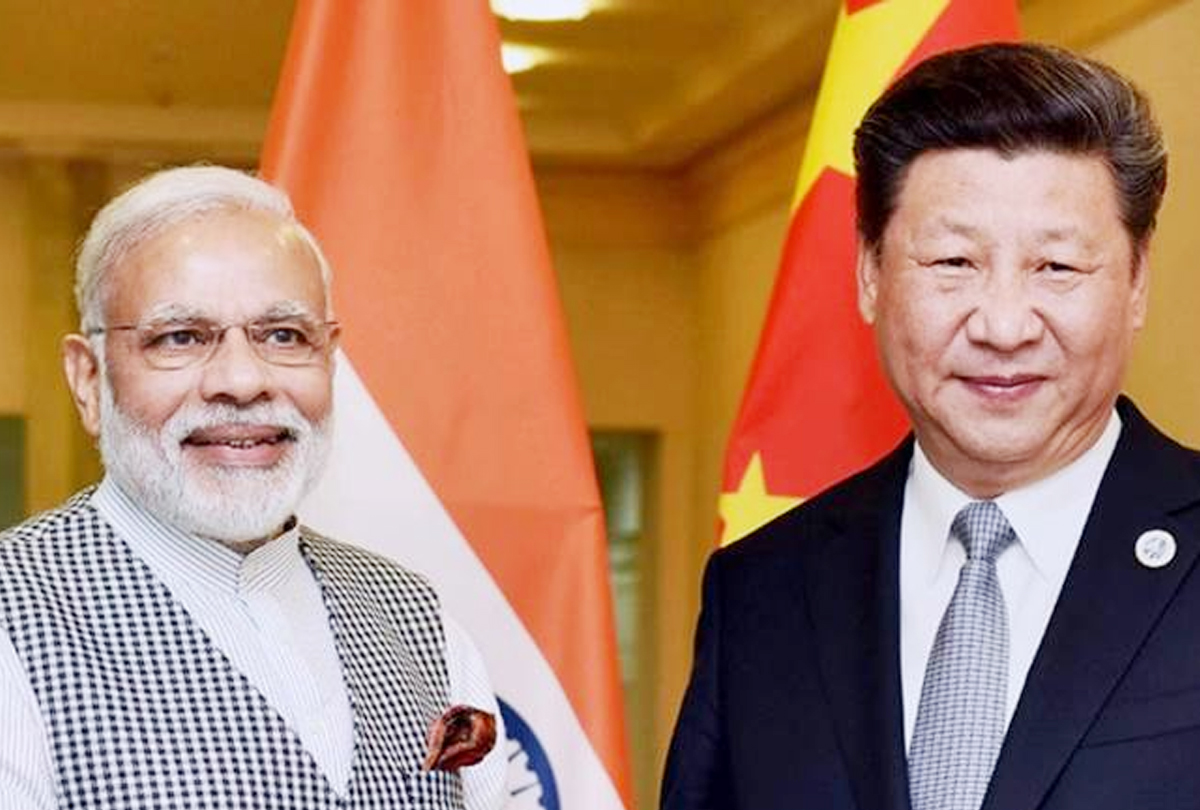

Chinese President’s India visit on track, confirms

-

'Howdy Modi' event 'win-win' situation for Modi an

-

Malala urges U.N. to help Kashmiri children go bac

-

Rocket blast at U.S. Embassy in Kabul on 9/11 anni

-

PM Modi launches $4.2 mn redevelopment project of

-

Pakistan Blacklisted by FATF's: After Failing to A

-

Amazon Rainforest burning: Brazil President tells

-

10 shoking pics of Amazon Rainforest Burning

-

200 pakistan twitter accounts suspended on kashmir

-

Trump dials Imran Khan, asks to ‘moderate rhetoric

-

No policy change on Kashmir, says U.S.

-

Hamza, the son of Osama bin Laden, is dead

-

Ethiopians planted more than 200 million trees in

-

Pakistani military aircraft crash: All 5 crew memb