Anil Ambani dispels investor concerns

[Edited By: Gaurav]

Wednesday, 12th June , 2019 06:58 pmAnil Ambani, president of the debt-laden Reliance Group, on Tuesday tried to dispel investor concerns regarding the group's debt service capacity.

The confirmation came after the collective capitalization of their firms fell to a record low of ? 20,691 crore on Monday, with five of the group's entities on the list touching their 52-week low.

"As of April 1, 2018, lenders of all categories have provided zero net additional liquidity or debt to any Reliance Group entity, yet the group has made aggregate debt service payments of more than $ 35,000 million. Rupees over the period of 14 months, "said Mr. Ambani added that Reliance Group was fully committed to meet all future obligations of debt service in a timely manner, through additional asset monetization plans that are already in place. in various stages of implementation.

Payments include capital refunds of ? 24,800 crore and interest payments of ? 10,600 crore.

Mr. Ambani said that during the last few weeks, the unjustified rumor campaign, the speculation and the hammering of all the shares of Reliance Group companies "has caused serious damage to all our shareholders".

Stocks go up

On Tuesday, after the conference call, most of Reliance Group's shares ended in green, except Reliance Communications and Reliance Naval and Engineering. However, the companies could not fully recover the losses made on Monday.

"These payments have been made against insurmountable odds and the most challenging financial environment that has been seen in the country in decades. To aggravate the issues, the regulatory bodies and the courts have not issued any final adjudication order in claims totaling more than ? 30,000 million years due that are due for more than 5 to 10 years to several group companies, especially Reliance Infrastructure Ltd., Reliance Power Ltd. and its affiliates. The final decisions have only been delayed excessively and repeatedly for one reason or another, "said Mr. Ambani.

When asked for comments, Sanjiv Bhasin, EVP markets and corporate affairs, IIFL Securities, told The Hindu: "I think it's too late for [Mr.] Anil Ambani, he has fallen into a debt trap. money or proportional assets to cover the debt of the Reliance Group The markets punish anyone who is closer to breaching He could not leave bad assets on time Banks have become very strong and there is no proliferation of loans and a constant equalization of the loans ".

Mr. Ambani lamented the continued total apathy and lack of any kind of support from the financial system which, he said, ultimately only significantly harmed the interests of the lenders, as well as all other stakeholders. He emphasized that the Trust Group had demonstrated its good faith in a manner not as uncertain as the previous one.

Expressing concern for the seven million retail shareholders of Reliance Group, Mr. Ambani said it was heartening to him personally that during the past 12 months, retail participation in all companies remained without erosion and consistency, confirming his belief of the strong support and good wishes of All the shareholders of the Reliance Group.

Mr. Ambani plans to transform the Group to be lightweight, with a minimum debt and a higher return on capital to improve the value for all Reliance Group shareholders.

Latest News

-

2-Doxy-D is a game-changer drug - discovered by sc

-

UP Covid News: Recovery rate rises 86 percent in U

-

Big B orders 50 oxygen concentrators from Poland,

-

Today is Akshay tritiya-PM Modi and Akhilesh yadav

-

Kanpur health department doing preparations to fig

-

UP Govt. must be held accountable for "failing" it

-

16 doctors in Unnao UP resign yesterday but retrac

-

Vaccine is safety cycle against corona pandemic-CM

-

Life of every person is priceless,rescue is the be

-

Kanpur Municipal Corporation will make dust free K

-

Corona vaccination: UP government withdraws the de

-

UP Government should follow the orders of Highcour

-

Uttar Pradesh-IG roaming in the city without the u

-

PM, take off those pink goggles, by which nothing

-

Rahul Gandhi's counterattack on BJP Government’s s

-

Happy international nurse day-PM Modi, Rahul Gandh

-

Online food delivery and liquor shops can open the

-

Egoistic BJP should work in public interest instea

-

High court directed UP Government to make a Covid

-

Isolation rooms to be built in industrial units, a

-

WHO has appreciated the effort of the Yogi Adityan

-

Brother is forced to carry his corona afflicted br

-

Lucknow- Free auto service for covid patients

-

Lucknow-Defense Minister and CM Yogi inaugurated

-

Wine shops opened in kanpur

-

Kanpur: oxygen demand 50 percent decrease as infec

-

Kanpur Crime Branch Police arrested 2 accused of i

-

Kanpur police's initiative to prevent corona infec

-

CM Yogi inspected the community health center in c

-

Corona's third wave: IIT professor claims not to c

World News

-

American president Appoints Two More Indian To Key

-

Arora Akanksha an Indian running for United Nation

-

Brazil thankes india with hanuman after receiving

-

Toronto protest against Indian citizenship law as

-

One-Of-A-Kind Wedding: After Groom's Father Gets A

-

Kim's Horse Ride On Sacred Mountain Hints At "Grea

-

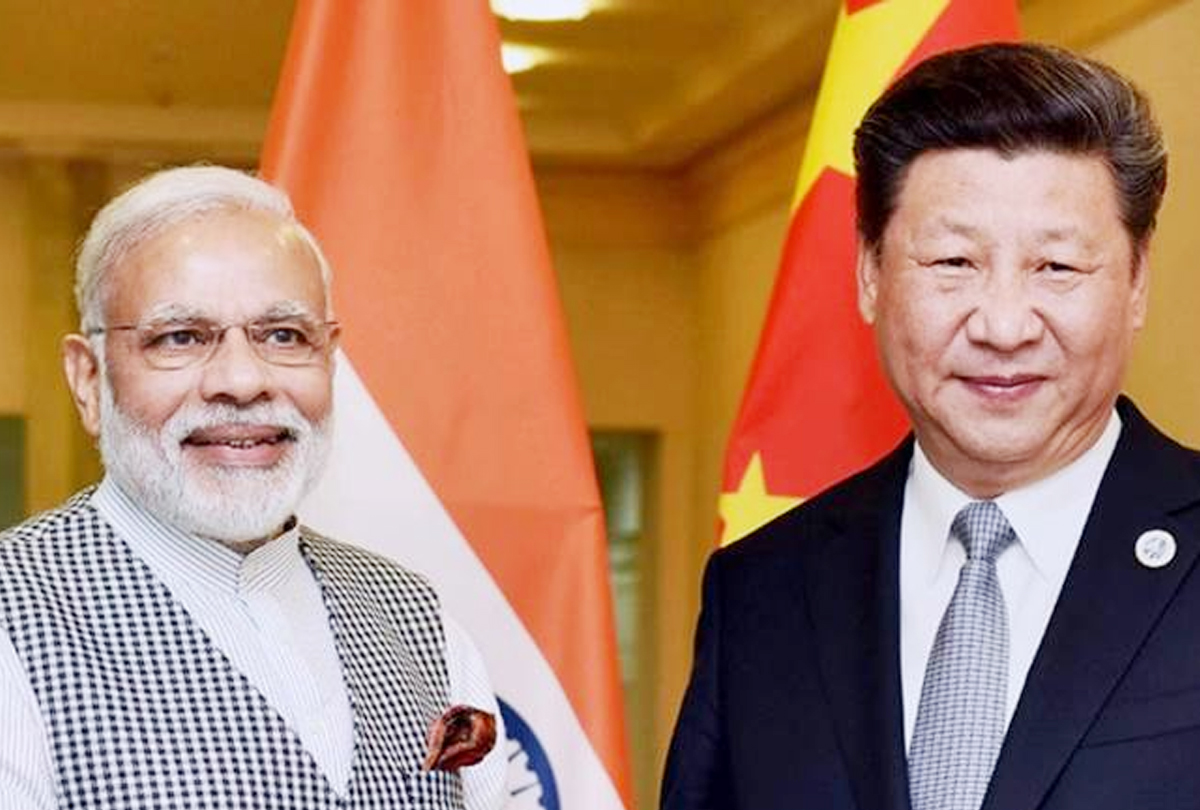

Chinese President’s India visit on track, confirms

-

'Howdy Modi' event 'win-win' situation for Modi an

-

Malala urges U.N. to help Kashmiri children go bac

-

Rocket blast at U.S. Embassy in Kabul on 9/11 anni

-

PM Modi launches $4.2 mn redevelopment project of

-

Pakistan Blacklisted by FATF's: After Failing to A

-

Amazon Rainforest burning: Brazil President tells

-

10 shoking pics of Amazon Rainforest Burning

-

200 pakistan twitter accounts suspended on kashmir

-

Trump dials Imran Khan, asks to ‘moderate rhetoric

-

No policy change on Kashmir, says U.S.

-

Hamza, the son of Osama bin Laden, is dead

-

Ethiopians planted more than 200 million trees in

-

Pakistani military aircraft crash: All 5 crew memb