Modi Government keeps options open for more fuel price hikes

[Edited By: Gaurav]

Sunday, 7th July , 2019 11:24 amWhile Finance Minister Nirmala Sitharaman had announced a ?1/litre increase in the Special Additional Duty (SAD) on petrol and diesel and a ?1/litre increase in the Road and Infrastructure Cess on the fuels in Friday’s Budget speech, the Finance Bill, which converts the Budget announcements into law, specified a higher increase in both the SAD and the Road and Infrastructure Cess, Mr. Pandey indicated to The Hindu.

According to the Budget announcement, the SAD would increase to ?8 per litre for petrol and ?2 per litre for diesel. The cess would increase to ?9 per litre for both fuels.

However, Clause 185 of the Finance Bill, which converts the Budget announcements into law, specified a higher increase in both the SAD and the Road and Infrastructure Cess. Clause 185 of the Bill… seeks to increase the rate of special additional duty of excise on motor spirit, commonly known as petrol, from ?7 per litre to ?10 per litre [and] increase the rate of special additional duty of excise on high speed diesel oil from ?1 per litre to ?4 per litre.

Similarly, Clause 201 of the Finance Bill seeks to “increase the rate of road and infrastructure cess on motor spirit commonly known as petrol and high speed diesel oil, from ?8 per litre to ?10 per litre”.

Taken together, this would amount to a ?5 per litre increase in the levies on the two fuels. While oil marketing companies have been instructed to only incorporate a total hike of ?2 per litre for the moment, the wording in the Finance Bill gives the government room to increase up to ? 5 per litre whenever it wants.

“The ceiling has been increased,” Mr Pandey told The Hindu. “Only the ceiling has been increased because you cannot go on changing the ceiling every time. Depending on the requirement, either the decision can be taken to either bring down the taxes or for them to go up.”

Mr Pandey added that the government expects to earn ?30,000 crore in a year due to the increase in levies on fuel, and about ? 22,000 crore from the remaining nine months of this financial year.

Latest News

-

2-Doxy-D is a game-changer drug - discovered by sc

-

UP Covid News: Recovery rate rises 86 percent in U

-

Big B orders 50 oxygen concentrators from Poland,

-

Today is Akshay tritiya-PM Modi and Akhilesh yadav

-

Kanpur health department doing preparations to fig

-

UP Govt. must be held accountable for "failing" it

-

16 doctors in Unnao UP resign yesterday but retrac

-

Vaccine is safety cycle against corona pandemic-CM

-

Life of every person is priceless,rescue is the be

-

Kanpur Municipal Corporation will make dust free K

-

Corona vaccination: UP government withdraws the de

-

UP Government should follow the orders of Highcour

-

Uttar Pradesh-IG roaming in the city without the u

-

PM, take off those pink goggles, by which nothing

-

Rahul Gandhi's counterattack on BJP Government’s s

-

Happy international nurse day-PM Modi, Rahul Gandh

-

Online food delivery and liquor shops can open the

-

Egoistic BJP should work in public interest instea

-

High court directed UP Government to make a Covid

-

Isolation rooms to be built in industrial units, a

-

WHO has appreciated the effort of the Yogi Adityan

-

Brother is forced to carry his corona afflicted br

-

Lucknow- Free auto service for covid patients

-

Lucknow-Defense Minister and CM Yogi inaugurated

-

Wine shops opened in kanpur

-

Kanpur: oxygen demand 50 percent decrease as infec

-

Kanpur Crime Branch Police arrested 2 accused of i

-

Kanpur police's initiative to prevent corona infec

-

CM Yogi inspected the community health center in c

-

Corona's third wave: IIT professor claims not to c

World News

-

American president Appoints Two More Indian To Key

-

Arora Akanksha an Indian running for United Nation

-

Brazil thankes india with hanuman after receiving

-

Toronto protest against Indian citizenship law as

-

One-Of-A-Kind Wedding: After Groom's Father Gets A

-

Kim's Horse Ride On Sacred Mountain Hints At "Grea

-

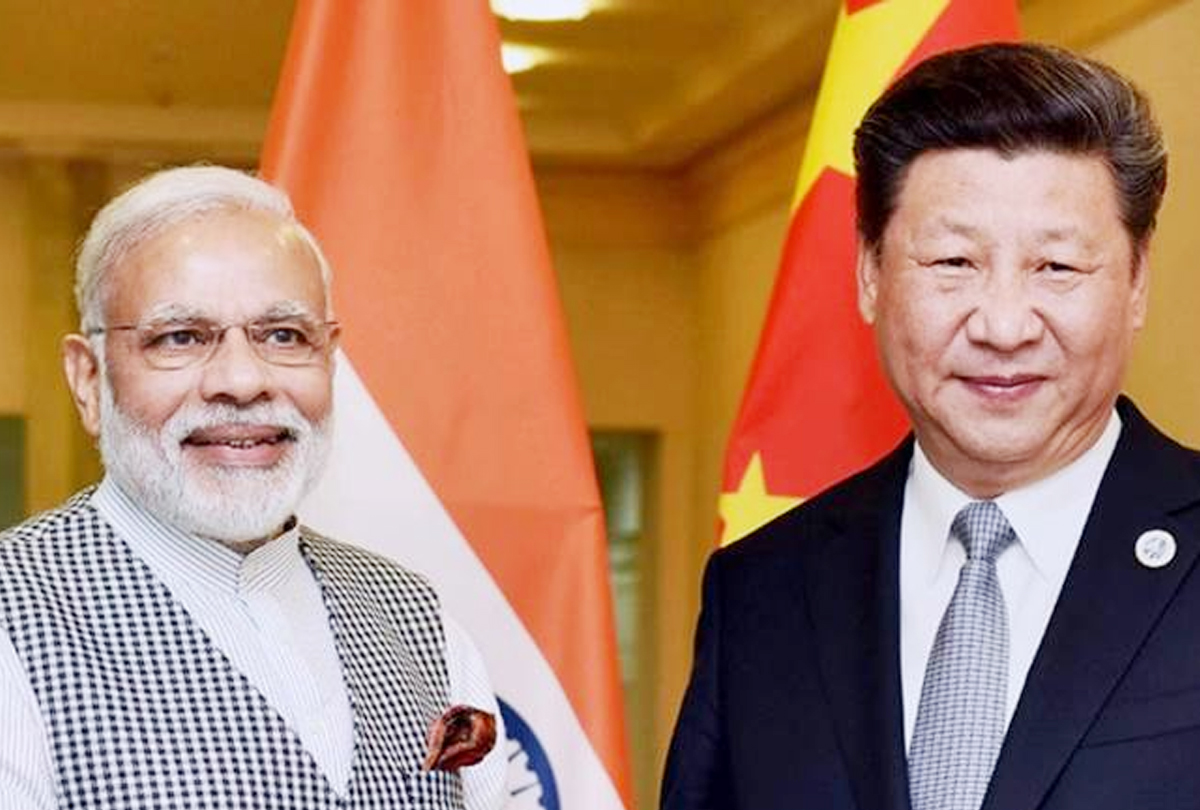

Chinese President’s India visit on track, confirms

-

'Howdy Modi' event 'win-win' situation for Modi an

-

Malala urges U.N. to help Kashmiri children go bac

-

Rocket blast at U.S. Embassy in Kabul on 9/11 anni

-

PM Modi launches $4.2 mn redevelopment project of

-

Pakistan Blacklisted by FATF's: After Failing to A

-

Amazon Rainforest burning: Brazil President tells

-

10 shoking pics of Amazon Rainforest Burning

-

200 pakistan twitter accounts suspended on kashmir

-

Trump dials Imran Khan, asks to ‘moderate rhetoric

-

No policy change on Kashmir, says U.S.

-

Hamza, the son of Osama bin Laden, is dead

-

Ethiopians planted more than 200 million trees in

-

Pakistani military aircraft crash: All 5 crew memb