Take good insurance for the monsoon

[Edited By: Gaurav]

Monday, 22nd July , 2019 01:30 pmCommon problems include the emergence of waterborne or viral diseases, seizure of engines by engines due to their jamming in floods and excessive damage to the property and its contents in the event of flooding.

The monsoon can certainly be a delightful season. But, although the rains provide a respite from the intense heat, they often leave a trail of losses.

To really enjoy the rainy season without thinking about financial setbacks, you need to protect your health, your vehicle and your home by using the right combination of insurance coverage.

With the onset of the rainy season, it becomes imperative to protect oneself and one's family against diseases such as diarrhea, dengue, viral fever, typhoid, malaria and chikungunya, which are among the most most common reported in hospitals. The cost of treating dengue fever is enormous, as most private hospitals in India charge between ¥ 10,000 and ¥ 15,000 for platelet separation.

If a patient is transfused up to four times, he or she must spend at least ¥ 40,000 to get platelets.

Patients who have spent up to 2,000 lakh for dengue treatment have also had more than four platelet transfusions. The treatment of the disease takes about 8 to 10 days and the rent of a room in a suitable hospital often exceeds 1 ¤ lakh.

Dengue fever is one of the most common diseases for which there are fixed benefit plans such as those offered by Apollo Munich (Dengue Care), Bajaj Allianz (M-Care) and DHFL (Pramerica Dengue Shield). You must buy one at the earliest because most of these policies have a waiting period of 30 to 45 days from the date of issue of the policy. The waiting time varies considerably from one product to another and from one insurer to another.

There are some exceptions, such as Max Bupa's Heart Beat plan, which does not provide for a specific disease-specific waiting period for people under 45 years of age.

During the monsoon season, the number of claims related to auto insurance increases significantly due to the penetration of water into the engine of the vehicle or due to an accident due to water saturation.

When buying a home insurance policy, you must remember to invest in a plan that not only protects the structure of your property, but also provides adequate coverage of its contents. Many insurers have introduced jewelery and valuables, personal electronics and appliances under the policy.

Latest News

-

2-Doxy-D is a game-changer drug - discovered by sc

-

UP Covid News: Recovery rate rises 86 percent in U

-

Big B orders 50 oxygen concentrators from Poland,

-

Today is Akshay tritiya-PM Modi and Akhilesh yadav

-

Kanpur health department doing preparations to fig

-

UP Govt. must be held accountable for "failing" it

-

16 doctors in Unnao UP resign yesterday but retrac

-

Vaccine is safety cycle against corona pandemic-CM

-

Life of every person is priceless,rescue is the be

-

Kanpur Municipal Corporation will make dust free K

-

Corona vaccination: UP government withdraws the de

-

UP Government should follow the orders of Highcour

-

Uttar Pradesh-IG roaming in the city without the u

-

PM, take off those pink goggles, by which nothing

-

Rahul Gandhi's counterattack on BJP Government’s s

-

Happy international nurse day-PM Modi, Rahul Gandh

-

Online food delivery and liquor shops can open the

-

Egoistic BJP should work in public interest instea

-

High court directed UP Government to make a Covid

-

Isolation rooms to be built in industrial units, a

-

WHO has appreciated the effort of the Yogi Adityan

-

Brother is forced to carry his corona afflicted br

-

Lucknow- Free auto service for covid patients

-

Lucknow-Defense Minister and CM Yogi inaugurated

-

Wine shops opened in kanpur

-

Kanpur: oxygen demand 50 percent decrease as infec

-

Kanpur Crime Branch Police arrested 2 accused of i

-

Kanpur police's initiative to prevent corona infec

-

CM Yogi inspected the community health center in c

-

Corona's third wave: IIT professor claims not to c

World News

-

American president Appoints Two More Indian To Key

-

Arora Akanksha an Indian running for United Nation

-

Brazil thankes india with hanuman after receiving

-

Toronto protest against Indian citizenship law as

-

One-Of-A-Kind Wedding: After Groom's Father Gets A

-

Kim's Horse Ride On Sacred Mountain Hints At "Grea

-

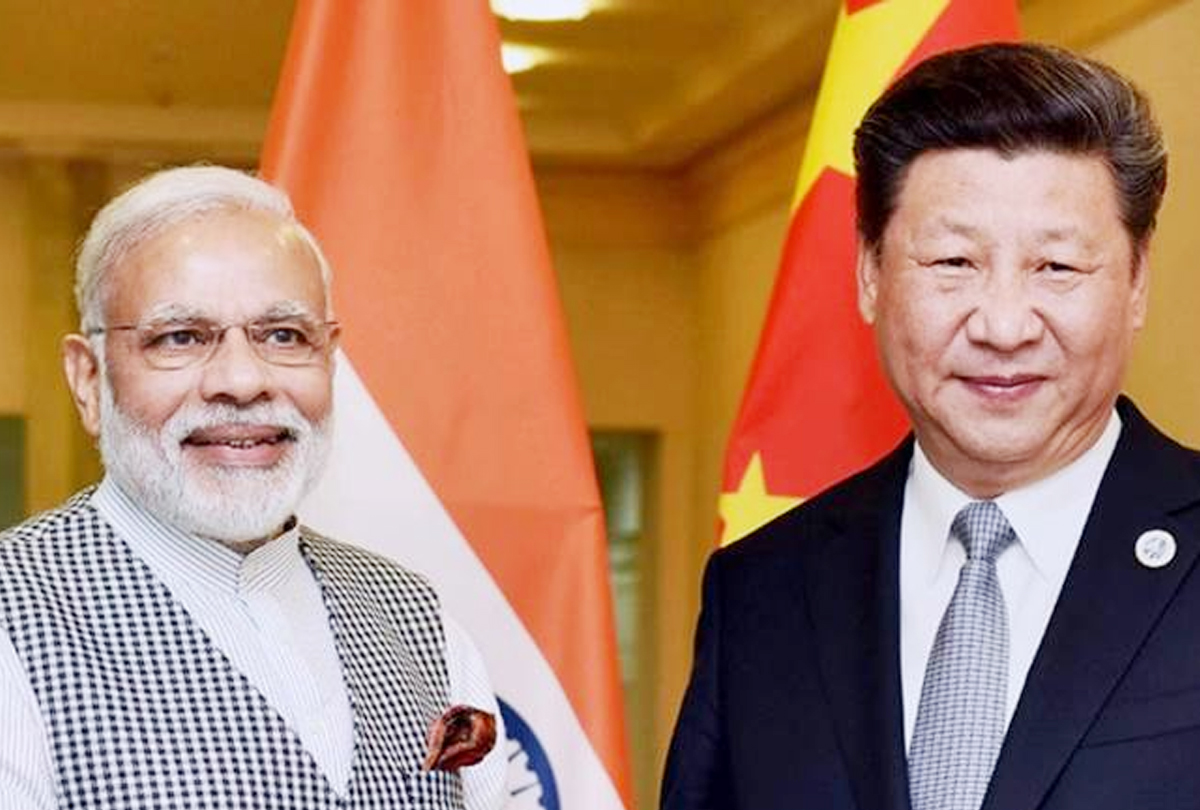

Chinese President’s India visit on track, confirms

-

'Howdy Modi' event 'win-win' situation for Modi an

-

Malala urges U.N. to help Kashmiri children go bac

-

Rocket blast at U.S. Embassy in Kabul on 9/11 anni

-

PM Modi launches $4.2 mn redevelopment project of

-

Pakistan Blacklisted by FATF's: After Failing to A

-

Amazon Rainforest burning: Brazil President tells

-

10 shoking pics of Amazon Rainforest Burning

-

200 pakistan twitter accounts suspended on kashmir

-

Trump dials Imran Khan, asks to ‘moderate rhetoric

-

No policy change on Kashmir, says U.S.

-

Hamza, the son of Osama bin Laden, is dead

-

Ethiopians planted more than 200 million trees in

-

Pakistani military aircraft crash: All 5 crew memb