RBI cuts repo rate by 35 bps to 5.40%

[Edited By: Gaurav]

Wednesday, 7th August , 2019 04:53 pmOn 7 August, the Reserve Bank of India (RBI) reduced the repo rate - its key interest rate - by 35 basis points to 5.40%, and left the door open to reducing rates by maintaining a policy "accommodating", but has expressed concerns about weakening growth prospects.

This was the fourth reduction in repo rates in as many contracts since February 2019. This is also the first time that the reference loan rate has been changed to a range other than multiples of 25. base points. This marks a major change from the prevailing practice that the central bank had lowered or raised rates by a multiple of 25 basis points.

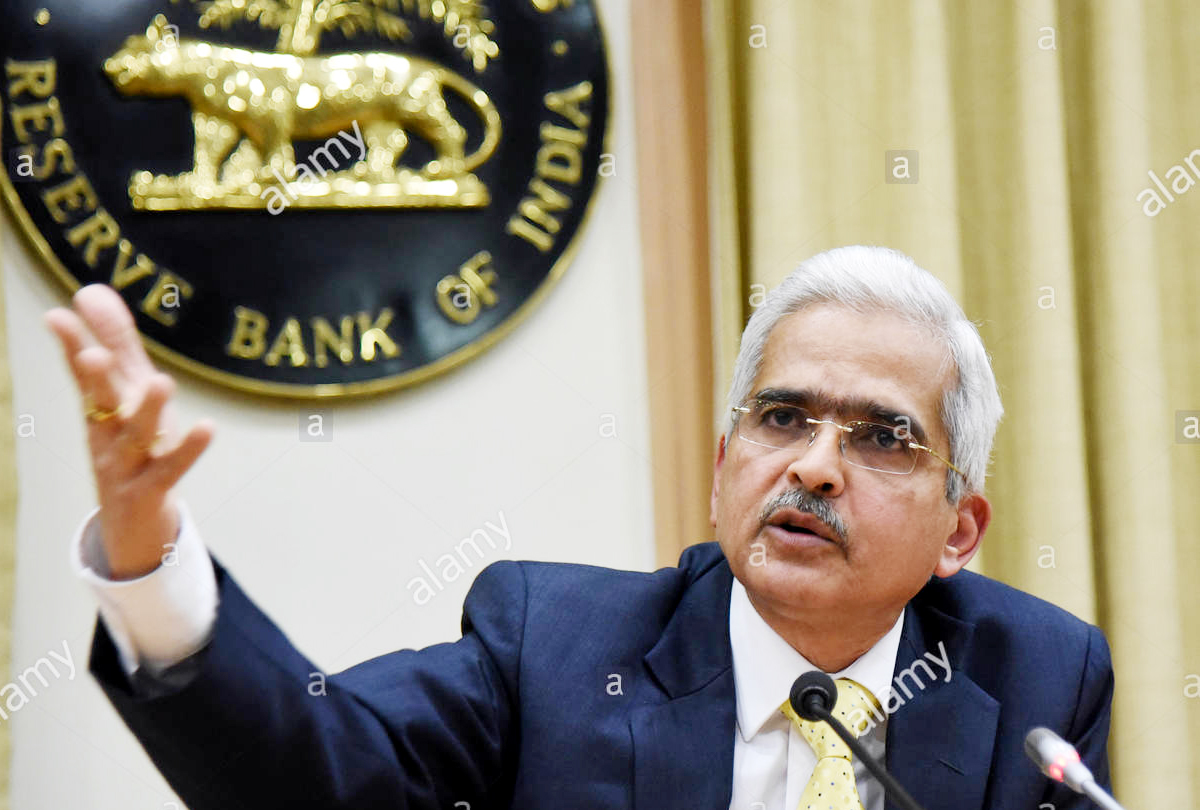

"There is nothing sacrosanct about 25 basis points or their multiples," RBI Governor Shaktikanta Das said at the post-political press conference.

The Committee of Monetary Policy (CPM), composed of six members and chaired by Das, however, was the scene of growing fears about the growth prospects of the economy at large, marked by stagnant consumption and investment activity .

The RBI now expects India's real or inflation-adjusted gross domestic product (GDP) to rise 6.9 percent in 2019-20, down from the 7 percent expected in June.

"Various high frequency indicators suggest a weakening of domestic and external demand conditions. The Business Outlook Index of the Reserve Bank Industrial Outlook Survey shows moderate growth in demand in the second quarter (July-September), although lower input costs bode well for growth "Says the RBI's monetary policy statement.

Weak household spending, as reflected in parameters such as declining car sales, led to an accumulation of unsold inventories and an increase in idle capacity in factories reflecting weaker demand and lower investment.

Inflation being decisively under control for the next 12 months, the RBI seems to have indicated a change of direction of its action in favor of the revival of the investment.

“Even as past rate cuts are being gradually transmitted to the real economy, the benign inflation outlook provides headroom for policy action to close the negative output gap. Addressing growth concerns by boosting aggregate demand, especially private investment, assumes the highest priority at this juncture while remaining consistent with the inflation mandate,” the statement said.

Automobile showrooms have not been reporting brisk activity, implying lower spending ability and flat income growth. Tractor and motorcycle sales – indicators of rural demand – continued to contract. Passenger vehicle sales contracted for the eighth consecutive month in June, although domestic air passenger traffic growth turned positive in June after falling for three consecutive months.

Commercial vehicle sales slowed down even after adjusting for base effects, mirroring how stocks aren’t moving rapidly across the country to fill shop shelves beaten by low demand. Construction activity indicators slackened, with contraction in cement production and slower growth in finished steel consumption in June. Import of capital goods – a key indicator of investment activity– contracted in June.

“Since the last policy (in June), domestic economic activity continues to be weak, with the global slowdown and escalating trade tensions posing downside risks. Private consumption, the mainstay of aggregate demand, and investment activity remain sluggish,” the statement said.

The MPC expects the inflation genie to remain firmly bottled up, and well within the central bank’s comfortable 4 percent range. Retail or consumer price index (CPI)-based inflation, the main price gauge that the central bank tracks for interest rate decisions, is projected at 3.1 percent during July-September 2019 and at 3.5-3.7 percent during October-March 2019-20. CPI inflation for April-June 2020 is projected at 3.6 percent.

The MPC, however, sounded a few caveats, including a possible rise in food inflation, particularly vegetables and pulses. “Uneven spatial and temporal distribution of monsoon could exert some upward pressure on food items, though this risk is likely to be mitigated by the recent catch up in rainfall,” it said.

Also, despite excess supply conditions, crude oil prices may likely remain volatile due to geo-political tensions in the Middle-East. The RBI’s outlook for CPI inflation excluding food and fuel also remains soft.

Four members (Ravindra H. Dholakia, Michael Debabrata Patra, Bibhu Prasad Kanungo and Shaktikanta Das) voted to reduce the policy repo rate by 35 basis points, while two members (Chetan Ghate and Pami Dua) voted to reduce the policy repo rate by 25 basis points.

Latest News

-

2-Doxy-D is a game-changer drug - discovered by sc

-

UP Covid News: Recovery rate rises 86 percent in U

-

Big B orders 50 oxygen concentrators from Poland,

-

Today is Akshay tritiya-PM Modi and Akhilesh yadav

-

Kanpur health department doing preparations to fig

-

UP Govt. must be held accountable for "failing" it

-

16 doctors in Unnao UP resign yesterday but retrac

-

Vaccine is safety cycle against corona pandemic-CM

-

Life of every person is priceless,rescue is the be

-

Kanpur Municipal Corporation will make dust free K

-

Corona vaccination: UP government withdraws the de

-

UP Government should follow the orders of Highcour

-

Uttar Pradesh-IG roaming in the city without the u

-

PM, take off those pink goggles, by which nothing

-

Rahul Gandhi's counterattack on BJP Government’s s

-

Happy international nurse day-PM Modi, Rahul Gandh

-

Online food delivery and liquor shops can open the

-

Egoistic BJP should work in public interest instea

-

High court directed UP Government to make a Covid

-

Isolation rooms to be built in industrial units, a

-

WHO has appreciated the effort of the Yogi Adityan

-

Brother is forced to carry his corona afflicted br

-

Lucknow- Free auto service for covid patients

-

Lucknow-Defense Minister and CM Yogi inaugurated

-

Wine shops opened in kanpur

-

Kanpur: oxygen demand 50 percent decrease as infec

-

Kanpur Crime Branch Police arrested 2 accused of i

-

Kanpur police's initiative to prevent corona infec

-

CM Yogi inspected the community health center in c

-

Corona's third wave: IIT professor claims not to c

World News

-

American president Appoints Two More Indian To Key

-

Arora Akanksha an Indian running for United Nation

-

Brazil thankes india with hanuman after receiving

-

Toronto protest against Indian citizenship law as

-

One-Of-A-Kind Wedding: After Groom's Father Gets A

-

Kim's Horse Ride On Sacred Mountain Hints At "Grea

-

Chinese President’s India visit on track, confirms

-

'Howdy Modi' event 'win-win' situation for Modi an

-

Malala urges U.N. to help Kashmiri children go bac

-

Rocket blast at U.S. Embassy in Kabul on 9/11 anni

-

PM Modi launches $4.2 mn redevelopment project of

-

Pakistan Blacklisted by FATF's: After Failing to A

-

Amazon Rainforest burning: Brazil President tells

-

10 shoking pics of Amazon Rainforest Burning

-

200 pakistan twitter accounts suspended on kashmir

-

Trump dials Imran Khan, asks to ‘moderate rhetoric

-

No policy change on Kashmir, says U.S.

-

Hamza, the son of Osama bin Laden, is dead

-

Ethiopians planted more than 200 million trees in

-

Pakistani military aircraft crash: All 5 crew memb